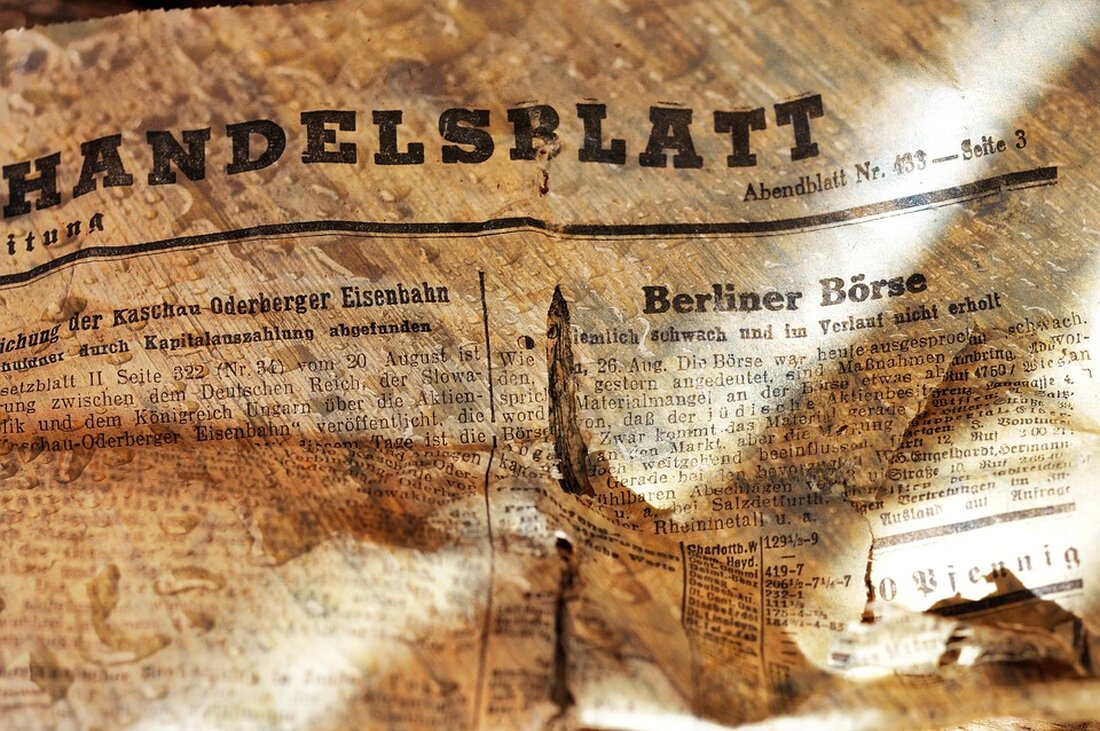

Handelsblatt

According to recent reports, the global economy could contract by up to 4.9% over the next two years. This is the direst scenario recorded since records began about 100 years ago. The reasons for the decline include the ongoing pandemic, disruption of global supply chains and decline in trade. Numerous industries, such as aviation, tourism and hospitality, are expected to be hit particularly hard by this crisis. Many companies have already made layoffs and pay cuts, and there are fears that a global recession could prompt investors to withdraw capital and move to safer investments. Financial experts…

Handelsblatt

According to recent reports, the global economy could contract by up to 4.9% over the next two years. This is the direst scenario recorded since records began about 100 years ago. The reasons for the decline include the ongoing pandemic, disruption of global supply chains and decline in trade. Numerous industries, such as aviation, tourism and hospitality, are expected to be hit particularly hard by this crisis. Many companies have already made layoffs and pay cuts, and there are fears that a global recession could prompt investors to withdraw capital and move to safer investments. Financial experts warn of continued volatility in financial markets and advise investors to be cautious and keep their portfolio diversified to mitigate potential losses.

The information from a financial professional's perspective has several implications. First, the expected global recession will lead to increased uncertainty in financial markets. Volatility will increase and investors may tend to sell risky assets. Secondly, the crisis will hit certain sectors particularly hard, which could lead to massive losses for companies and investors. For example, aviation, tourism and hospitality sectors are expected to take longer to recover from the impact. Finally, financial professionals should note that a diversified investment strategy is crucial during times of uncertainty to mitigate losses and take advantage of potential opportunities. Overall, the article shows that the global economy is facing major challenges and that financial experts advise investors to be cautious and consider their investments carefully.

Read the source article at www.handelsblatt.com

Suche

Suche

Mein Konto

Mein Konto