Microsoft share price hardly changed - analysis from financial experts

According to a report from www.ariva.de, the price of Microsoft shares has hardly changed. The current price is only slightly higher with a price increase of 0.17 percent and amounts to 407.25 US dollars. The appreciation of private and institutional investors for Microsoft shares has hardly changed. Even if the price has hardly moved, Microsoft's security is doing better than the overall market, as measured by the NASDAQ 100, which is currently trading at 17,804 points, which corresponds to a minus of 0.23 percent compared to the last price of the previous trading day. Microsoft shares recorded their highest price to date on...

Microsoft share price hardly changed - analysis from financial experts

According to a report from www.ariva.de, the price of Microsoft shares has hardly changed. The current price is only slightly higher with a price increase of 0.17 percent and amounts to 407.25 US dollars. The appreciation of private and institutional investors for Microsoft shares has hardly changed. Even if the price has hardly moved, Microsoft's security is doing better than the overall market, as measured by the NASDAQ 100, which is currently trading at 17,804 points, which corresponds to a minus of 0.23 percent compared to the last price of the previous trading day. Microsoft shares recorded their highest price to date on February 9, 2024.

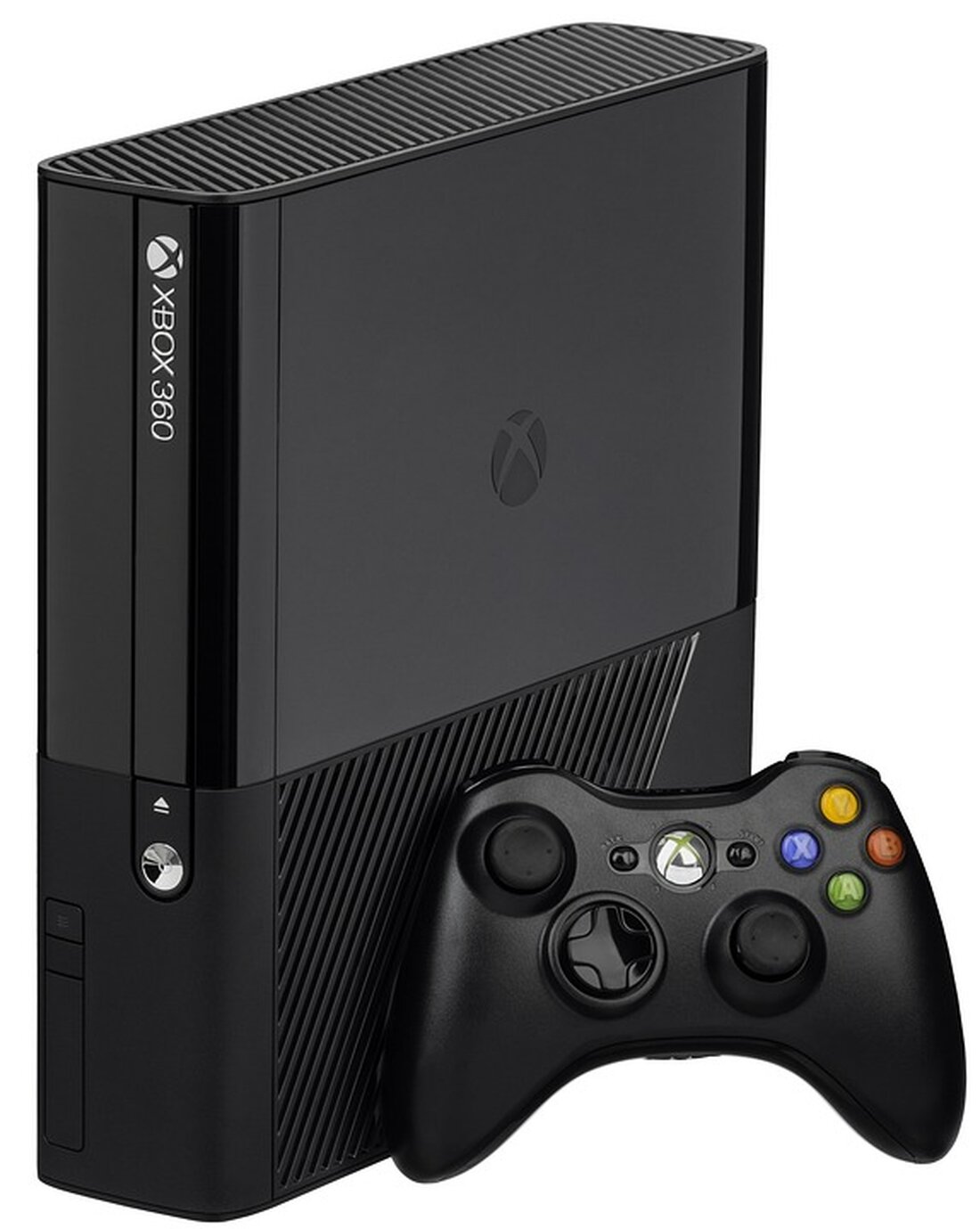

Microsoft is a world-leading manufacturer of PC software and as such has set standards with its solutions. The group's product range extends from operating systems and server software to application programs, application software for companies and private users to entertainment applications on mobile and stationary devices. In addition to the online services Bing and MSN Portals, the portfolio also includes Skype (internet telephony) and products and services related to the Xbox games console.

Microsoft's stagnant share price can have various causes. A possible reason could be the general development of the technology market. If other technology companies also show stagnant prices, this could indicate a general consolidation in the market. Another possibility could be the performance of the company itself, for example through management changes, new products or economic reports.

The current stagnation in Microsoft's share price is unlikely to have an immediate impact on the overall stock market. However, long-term investors may become concerned and start reducing their positions, which could lead to further downward pressure on the price. Overall, Microsoft's stagnant share price shows that the company is currently not meeting investors' expectations, which could ultimately affect confidence in the company and its long-term development.

Read the source article at www.ariva.de

Suche

Suche

Mein Konto

Mein Konto