Oil prices are rising again: US government is replenishing strategic oil reserves

According to a report from finanzen.net, oil prices rose again on Friday after previously recording significant losses. A barrel of North Sea Brent cost $75.94 for delivery in February, an increase of $1.91 compared to the previous day. The price for a barrel of the American variety West Texas Intermediate (WTI) rose by $1.88 to $71.21. Despite this recovery, oil prices remain battered and Brent prices are poised for their seventh consecutive weekly loss, which would be the longest since 2018. The background for the ongoing skepticism in the market is the recent production cuts by the large crude oil association OPEC+,...

Oil prices are rising again: US government is replenishing strategic oil reserves

According to a report from finanzen.net, oil prices rose again on Friday after previously recording significant losses. A barrel of North Sea Brent cost $75.94 for delivery in February, an increase of $1.91 compared to the previous day. The price for a barrel of the American variety West Texas Intermediate (WTI) rose by $1.88 to $71.21.

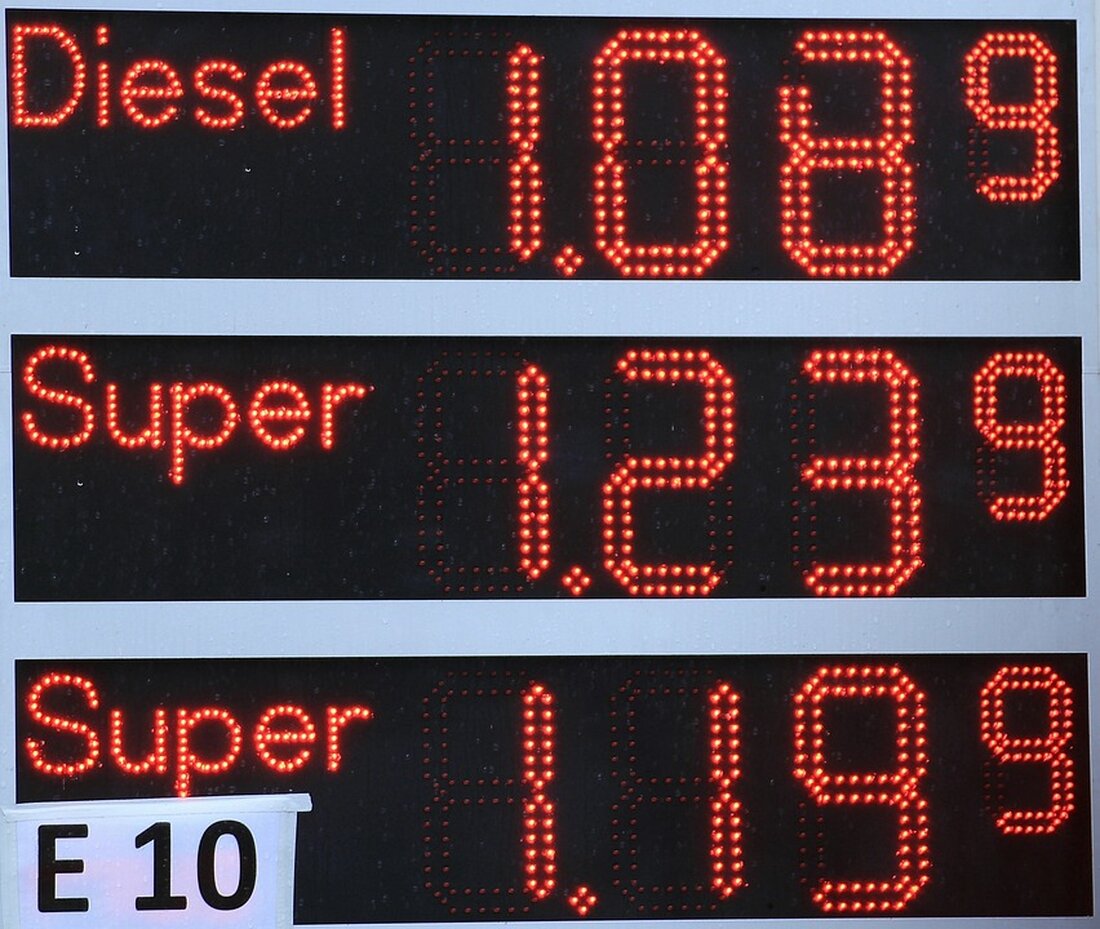

Despite this recovery, oil prices remain battered and Brent prices are poised for their seventh consecutive weekly loss, which would be the longest since 2018. The background for the ongoing skepticism in the market is the recent production cuts by the large crude oil association OPEC+, which market participants doubt whether they will be enforced. There is also a high supply of oil from non-OPEC countries such as the USA, and a gloomy economic outlook is weighing on the demand side, which could lead to weaker demand for crude oil, gasoline and diesel.

As a financial expert, it can be analyzed that the increase in the strategic oil reserve by the US government and the monthly tenders until at least May have contributed to a temporary support of oil prices, but the long-term effects are uncertain. Continuing market skepticism about the effectiveness of production cuts and high oil supply from non-OPEC countries could continue to put pressure on prices. In addition, the gloomy economic outlook is a potential negative factor for the demand side.

Overall, increased volatility in oil prices is to be expected, as market participants will continue to pay attention to the implementation of production cuts and the development of oil supply from non-OPEC countries as well as to economic indicators. These factors can lead to short-term price movements and are therefore important to investors and the energy market as a whole. However, the long-term impact depends on various geopolitical, economic and market factors and remains uncertain for now.

Read the source article at www.finanzen.net

Suche

Suche

Mein Konto

Mein Konto