Wall Street index Dow Jones Industrial exceeds 36,000 points - significance for investors

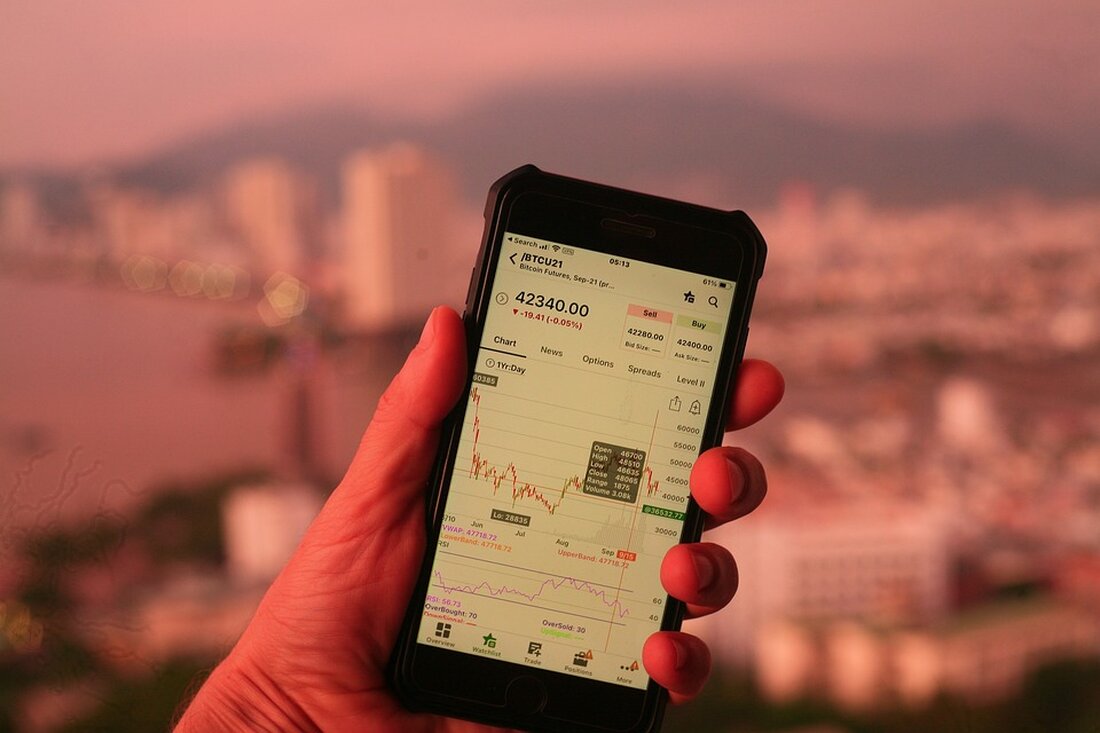

According to a report from www.focus.de, the Dow Jones Industrial has exceeded the 36,000 point mark and reached a new high since the beginning of last year, just like the Nasdaq 100. Both the Dow Jones and the Nasdaq 100 recorded increases of 0.43 percent to 36,404.93 points and 0.85 percent to 16,221.74 points, respectively. The S&P 500 also gained 0.39 percent to 4622.44 points. The driver of this upward movement is the expectation that central banks have made progress in the fight against high inflation and that key interest rates could therefore possibly be lowered early next year. With the upcoming interest rate decisions from...

Wall Street index Dow Jones Industrial exceeds 36,000 points - significance for investors

According to a report by www.focus.de, the Dow Jones Industrial has exceeded the 36,000 point mark and reached a new high since the beginning of last year, just like the Nasdaq 100. Both the Dow Jones and the Nasdaq 100 recorded increases of 0.43 percent to 36,404.93 points and 0.85 percent to 16,221.74 points, respectively. The S&P 500 also gained 0.39 percent to 4622.44 points.

The driver of this upward movement is the expectation that central banks have made progress in the fight against high inflation and that key interest rates could therefore possibly be lowered early next year. With the upcoming interest rate decisions by the US Federal Reserve and the central banks in Frankfurt and London, it is exciting to see whether and when interest rates will be lowered. US consumer prices for November are also important.

The possible reduction in key interest rates could have a significant impact on the market. Lower interest rates could increase demand for bonds, which in turn could affect stock prices. Additionally, a rate cut could stimulate consumer spending and investment, which could have positive effects on the economy and the market.

However, it remains to be seen how the central banks will react to the current economic indicators and what concrete steps they will take with regard to key interest rates. Therefore, investors should keep a close eye on these developments and make decisions accordingly.

Read the source article at www.focus.de

Suche

Suche

Mein Konto

Mein Konto