Siemens Energy: Losers and winners of the week - financial expert gives assessment

Siemens Energy is both the loser and the winner of the week! The company presented itself to the federal government. Siemens Energy ended the week up 9%. However, the prices are still at one of the lowest levels that Siemens Energy has ever reached. The bottom line is that the week was a horror with a loss of around 30% (depending on the stock exchange and perspective) - or is it an opportunity for bargain hunters? The company presented itself to the federal government last week - or according to a report last week in “Wirtschaftswoche”. It requires guarantees…

Siemens Energy: Losers and winners of the week - financial expert gives assessment

Siemens Energy is both the loser and the winner of the week! The company presented itself to the federal government.

Siemens Energy ended the week up 9%. However, the prices are still at one of the lowest levels that Siemens Energy has ever reached. The bottom line is that the week was a horror with a loss of around 30% (depending on the stock exchange and perspective) - or is it an opportunity for bargain hunters?

The company presented itself to the federal government last week - or according to a report last week in “Wirtschaftswoche”. The core message is that guarantees are needed in order to be able to continue to grow or to accept orders.

The financial market reacted to the message with a sharp discount. At times it fell by up to -34% in one day. Only gradually did investors become aware of the fact that Siemens Energy was not seeking a loan. The company wants guarantees or a surety bond to obtain loans. This fits with the idea of wanting to finance growth through new orders.

The subsidiary Gamesa has had serious problems with wind turbines this year and has also burdened Siemens Energy with the loss. The annual result is estimated at a loss of more than -4 billion euros. These two processes were initially assessed together - the high losses and the need for surety bonds.

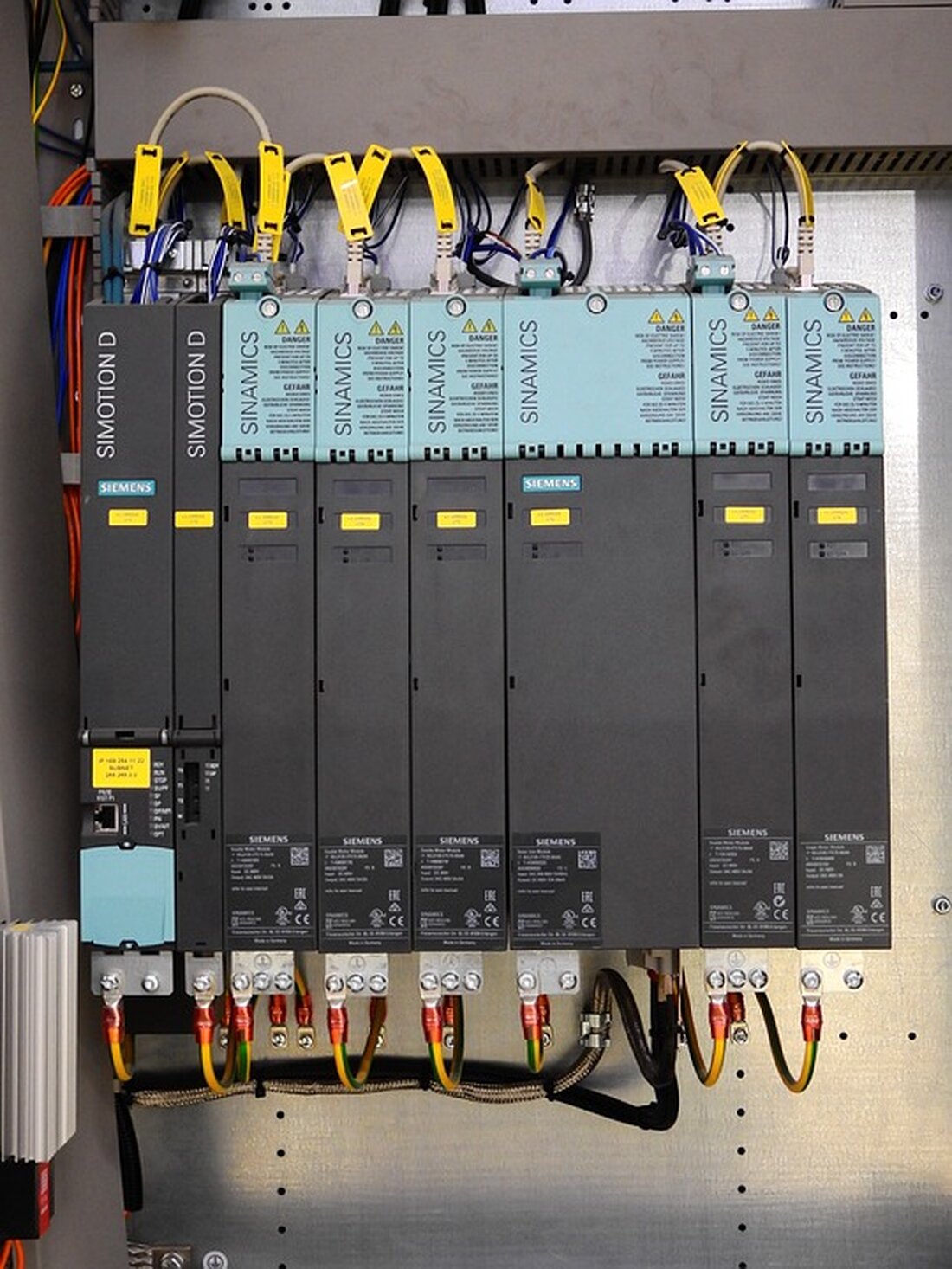

The chart image is accordingly horrendous.

Thursday's slump also has a massive impact on the price statistics. The share is well under 10 euros and has formally fallen by more than -50% since the beginning of the year.

However, there are many indications that the federal government is actually providing guarantees. This can lead to a liberation if there are not just declarations of intent, but real commitments. Things should continue to be very lively in the new week.

According to a report by www.finanztrends.de,

Source: https://www.finanztrends.de/siemens-energy-aktie-was-fuer- outlooken/

Read the source article at www.finanztrends.de

Suche

Suche

Mein Konto

Mein Konto