US stock exchanges: Dow Jones and Nasdaq slightly up - market hopes for falling key interest rates and expects quiet trading before Thanksgiving.

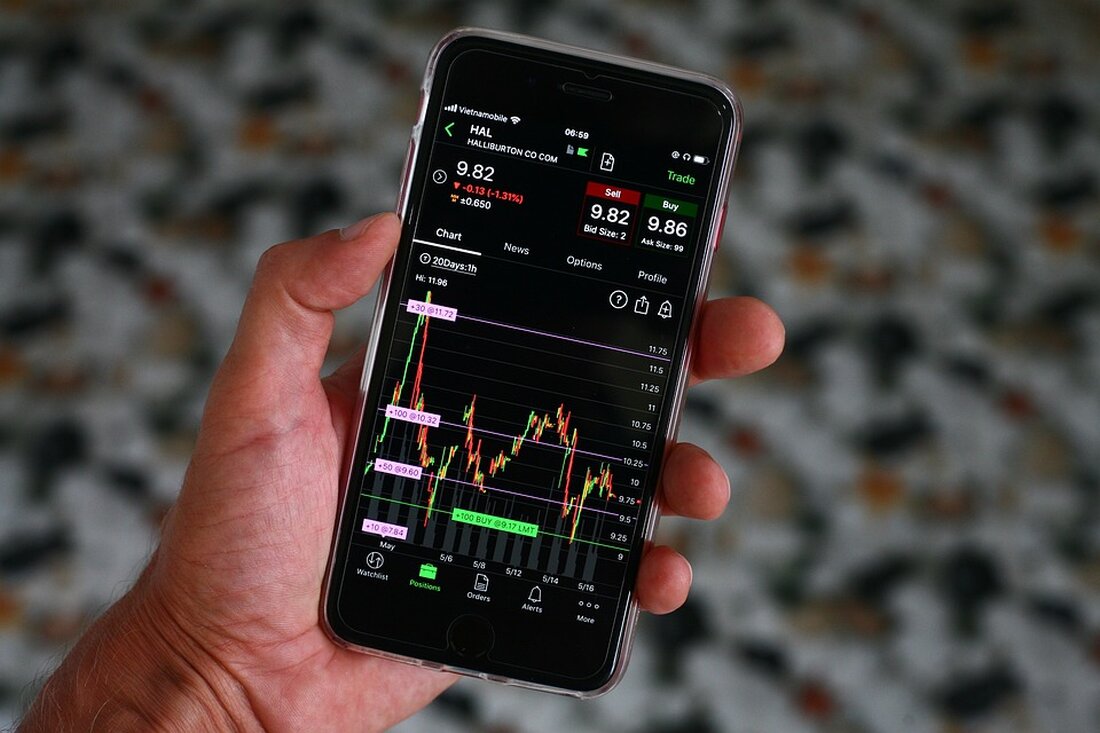

According to a report from www.boerse.de, the US stock markets are friendly ahead of the Thanksgiving holiday. The Dow Jones Industrial rose 0.14 percent to 35,137 points, while the Nasdaq 100 gained 0.47 percent. Investors are hoping for falling key interest rates next year and are confident that the US Federal Reserve has inflation under control. Quiet trading is expected due to the upcoming holiday. Individual companies, such as Nvidia and Microsoft, are in the focus of investors. Positive analyst comments on Nvidia following a strong quarterly report gave the company a boost in premarket trading. Shares rose 0.3 percent despite business...

US stock exchanges: Dow Jones and Nasdaq slightly up - market hopes for falling key interest rates and expects quiet trading before Thanksgiving.

According to a report by www.boerse.de, the US stock markets appear friendly before the Thanksgiving holiday. The Dow Jones Industrial rose 0.14 percent to 35,137 points, while the Nasdaq 100 gained 0.47 percent. Investors are hoping for falling key interest rates next year and are confident that the US Federal Reserve has inflation under control. Quiet trading is expected due to the upcoming holiday. Individual companies, such as Nvidia and Microsoft, are in the focus of investors.

Positive analyst comments on Nvidia following a strong quarterly report gave the company a boost in premarket trading. Shares rose 0.3 percent despite business in China being hit by U.S. government supply restrictions. Microsoft, on the other hand, is expected to benefit from a revival following a leadership change at OpenAI as its ousted CEO returns to the top spot. This is seen as a significant victory for Microsoft, a major investor in OpenAI.

Deere shares, however, fell almost six percent in premarket trading after the company announced a surprisingly low net profit for 2024.

The impact of these developments on the market can be both positive and negative. The hope of falling key interest rates could lead to an increase in investments and support the stock market. However, trading restrictions and profit warnings from companies like Deere could lead to uncertainty and possible share price declines. It remains to be seen how these developments will impact the financial industry in the long term.

Read the source article at www.boerse.de

Suche

Suche

Mein Konto

Mein Konto