ASML shares: top investment for dividends and price gains - analysis by a financial expert

According to a report from www.boerse-online.de, who doesn't dream of retiring from working life earlier and making a living from stock profits and dividend payments? One stock that could be considered for this is one of the largest European semiconductor companies, here are the details. The company is the Netherlands-based group ASML. The Dutch are market leaders in the development, construction, upgrade and maintenance of machines for the semiconductor industry. Full order books The European Union as well as the USA and Japan are very interested in greater independence in the chip sector and are prepared to give billions in subsidies to...

ASML shares: top investment for dividends and price gains - analysis by a financial expert

According to a report by www.boerse-online.de,

Who doesn't dream of quitting their careers earlier and making a living from stock profits and dividend payments? One stock that could be considered for this is one of the largest European semiconductor companies, here are the details.

The company is the Netherlands-based group ASML. The Dutch are market leaders in the development, construction, upgrade and maintenance of machines for the semiconductor industry.

Full order books

The European Union as well as the USA and Japan are very interested in greater independence in the chip sector and are ready to give billions in subsidies to strengthen domestic chip production. One of the biggest beneficiaries of this strategy is likely to be ASML. According to company information, the order backlog is around $39 billion, which is around one and a half times as much as last year's total sales.

That's what analysts say

The vast majority of analysts have recently revised their assessments of the stock. JPMorgan, among others, has the share on the buy list with an “Overweight” rating and a price target of 800 euros, while the Hamburg private bank Berenberg also has the share on “Buy” with a price target of 880 euros.

Strong development

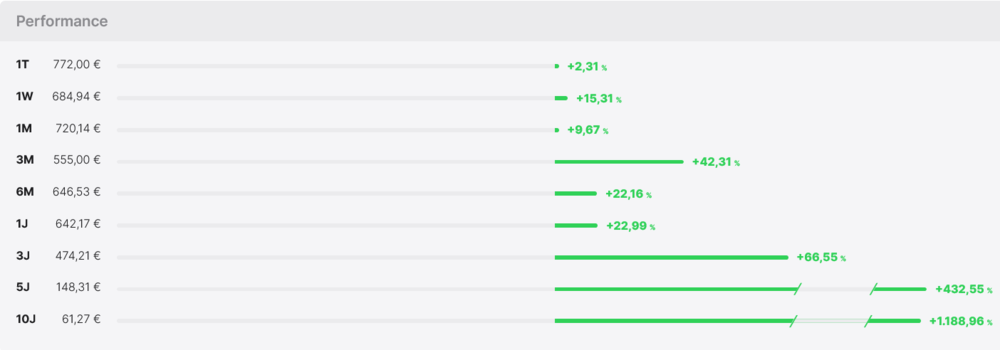

Investors who have been ASML shareholders since 2017 are pleased with massive dividend increases. Starting from 2017 with a dividend of 1.40 euros, payments in 2023 have more than quadrupled to 5.96 euros. Things are looking just as good when it comes to the share price development - investors were able to make big profits on all of the timelines shown here. With a P/E ratio of just under forty, the share is fairly valued thanks to the very good growth prospects. Investors wait for price pullbacks – if there are any – and get in.

Conclusion

ASML is a member of the BÖRSE Online Chip Power Index. The computer chip developer AMD currently has the highest index weighting, ahead of the semiconductor manufacturer Qualcomm and Intel. With the index certificate WKN DA0ABM, investors can benefit almost one-to-one from the development of 15 chip companies. The index has already gained almost 10 percent since the beginning of the year. More information about the index can be found here.

Also read: Double-digit dividend growth in 2024 – These values are likely to increase their payouts significantly

Or: Discovered: The best ETF in the world - and that's why you can look forward to even more growth in the future

The article contains important information about ASML's massive growth and promising future prospects. The high demand for chip production and the company's full order books indicate a strong market position. The positive assessments by analysts and the massive dividend increases are promising indicators for potential investors. The well-founded valuation of the share and the recommendations of the experts indicate that ASML continues to be an attractive investment. The future prospects for the company and the industry are promising.

Read the source article at www.boerse-online.de

Suche

Suche

Mein Konto

Mein Konto