Qube hedge fund bets 1 billion euros against Dax - founders rely on data and weak German economy #Qube #Hedgefonds #Dax

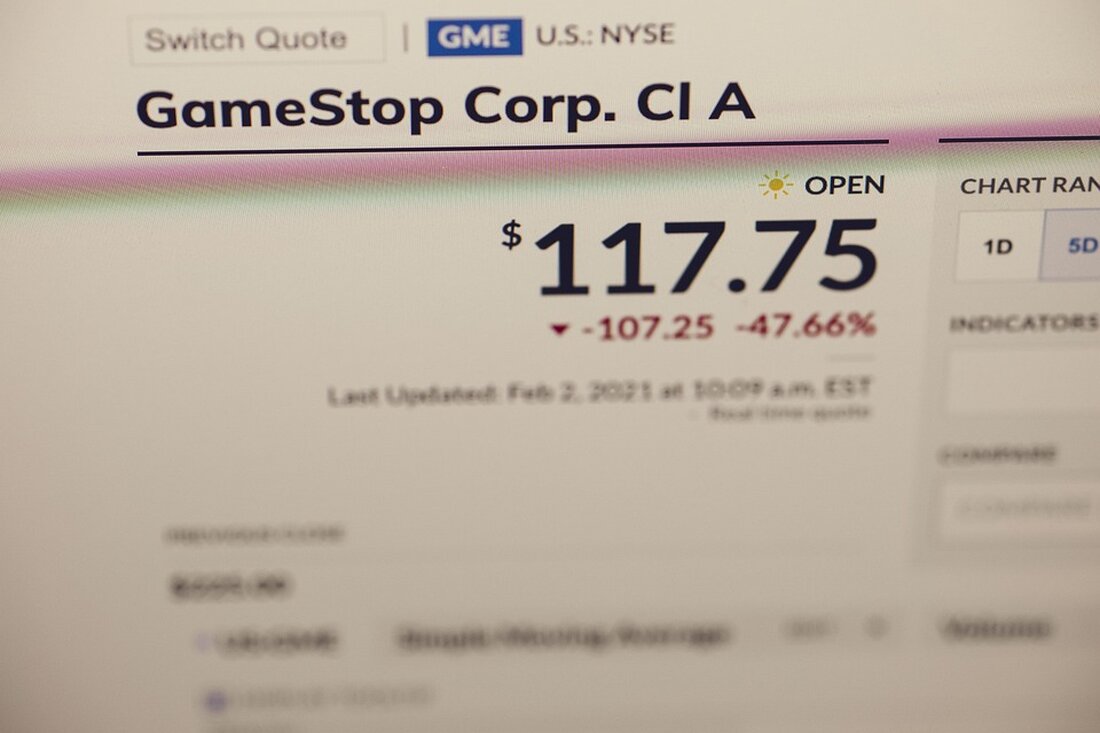

According to a report from www.capital.de, the London hedge fund Qube is betting a billion euros against German stocks. The founders of the fund come from France and seem rather inconspicuous, but they have recognized the potential of data. Earning money from the weakening German economy - that is apparently the goal of a billion-dollar hedge fund from London. Qube Research and Technology (QRT) has bet a total of $1 billion this week against major German companies such as Volkswagen, Siemens Energy and Rheinmetall, betting on falling German stock prices. The founders Pierre-Yves Morlat and Laurent Laizet have made a name for themselves in traditional banking and...

Qube hedge fund bets 1 billion euros against Dax - founders rely on data and weak German economy #Qube #Hedgefonds #Dax

According to a report from www.capital.de,

The London hedge fund Qube is betting one billion euros against German stocks. The founders of the fund come from France and seem rather inconspicuous, but they have recognized the potential of data. Earning money from the weakening German economy - that is apparently the goal of a billion-dollar hedge fund from London. Qube Research and Technology (QRT) has bet a total of $1 billion this week against major German companies such as Volkswagen, Siemens Energy and Rheinmetall, betting on falling German stock prices. The founders Pierre-Yves Morlat and Laurent Laizet made a name for themselves in traditional banking and are now more data-driven than ever in their middle age.

According to an analysis by www.capital.de, Qube has bet more than 1 billion euros against German stocks. This bet on falling German stock prices could have massive effects on the German market and the companies affected. If prices actually fall, this could lead to a massive loss for the companies mentioned. This could continue to have an impact on the German market as a whole and also affect consumer confidence.

The current economic uncertainties in Germany, such as the energy crisis and increased interest rates, have already led to difficulties in the German economy. Additional savings in the federal budget are unlikely to provide any relief this year, and the Munich Ifo Institute has already revised its growth forecast for 2024 downwards. In addition, companies expect their exports to decline, particularly in the core sectors of automotive engineering, mechanical engineering and electrical engineering.

Despite these developments, the German leading index DAX has increased slightly in recent weeks. However, according to experts, this could be explained in the context of an upcoming weekend and should not be interpreted as a long-term trend.

It remains to be seen how Qube's bet will affect the German market and the companies affected. The next few weeks will show whether the hedge fund's forecasts come true and what impact this will have on the German economy.

Read the source article at www.capital.de

Suche

Suche

Mein Konto

Mein Konto