Expert explains: What insurance do you really need?

Find out from an expert which insurance is really necessary and which you can do without. Clarify the important question: which ones do you need and which ones don't?

Expert explains: What insurance do you really need?

Some insurance is necessary while others are optional. According to the Federal Statistical Office, German households spent an average of 1,596 euros per year on insurance. But what insurance should you really have? Health insurance and motor vehicle liability insurance are required by law. Dr. Peter Grieble from the Baden-Württemberg Consumer Center emphasizes the importance of term life insurance, especially in partnerships with children, in order to avoid financial ruin in the event of the death of the main earner. Likewise, Dr. Grieble to protect against biometric risks such as illness, accidents or need for care.

The essential insurance policies include private liability insurance and occupational disability insurance, which protect against financial damage in everyday life and in the event of possible occupational disability. Child disability insurance and term life insurance are particularly important for families to cover serious illnesses or accidents and ensure financial security.

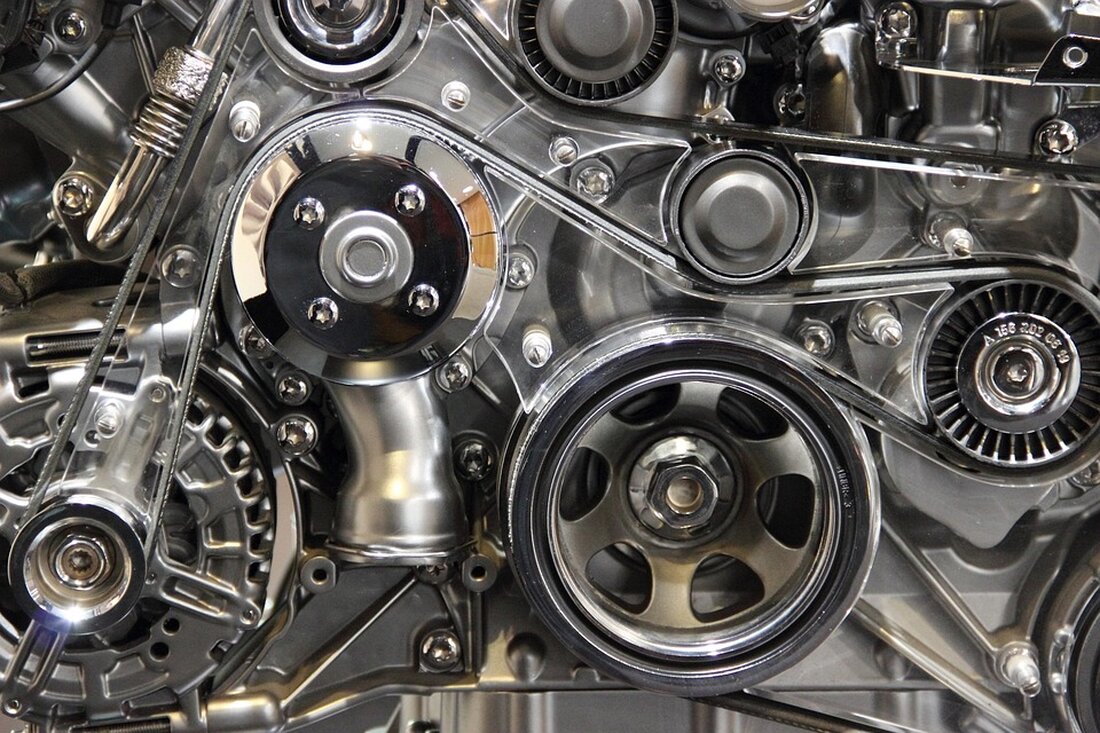

In addition, residential building insurance, natural disaster insurance and household contents insurance can be useful in order to be protected against damage to real estate, natural disasters and household contents. Fully comprehensive insurance for expensive cars is recommended, while insurance such as glass breakage insurance or smartphone insurance is considered unnecessary as they are less financially relevant and can often be covered independently through substitution.

Finally, Dr. Grieble says that the choice of insurance depends on individual financial possibilities and that prioritization is essential. In cases of biometric risks that cannot be substituted, appropriate coverage is essential, while in cases of lesser financial damage, a close review of the need is recommended.

Suche

Suche

Mein Konto

Mein Konto