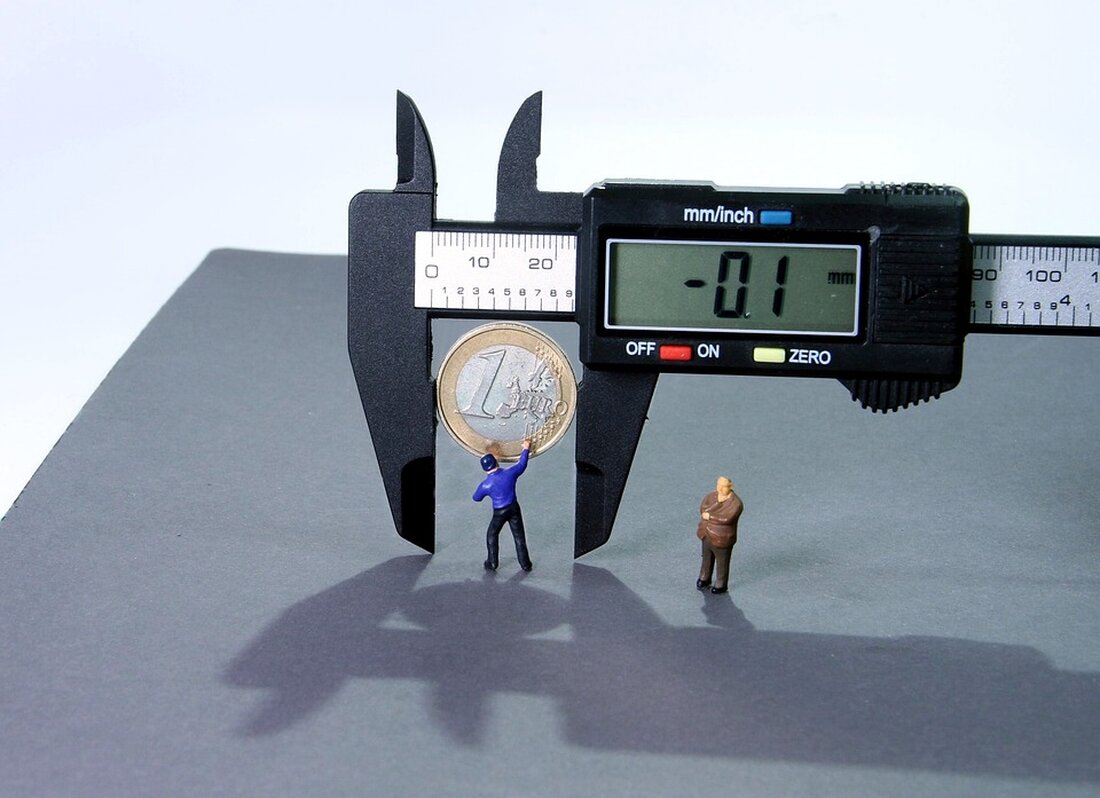

Interest rates above inflation: Why savers' luck could soon be over

According to a report from www.n-tv.de, interest rates for savers in Germany are rising while the inflation rate has fallen. This resulted in the money saved in the bank actually increasing. However, there are already signs of a trend reversal and it is questionable whether interest rates will continue to rise. Overall, millions of savers benefited from increased interest rates for the first time in 2023, mainly due to interest rate increases by the European Central Bank in the fight against high inflation. However, the falling inflation rate and weakening economy mean that the pressure on the monetary authorities to reduce key interest rates is increasing. This is already reflected in the fixed-term deposit conditions...

Interest rates above inflation: Why savers' luck could soon be over

According to a report by www.n-tv.de, interest rates for savers in Germany are rising while the inflation rate has fallen. This resulted in the money saved in the bank actually increasing. However, there are already signs of a trend reversal and it is questionable whether interest rates will continue to rise.

Overall, millions of savers benefited from increased interest rates for the first time in 2023, mainly due to interest rate increases by the European Central Bank in the fight against high inflation. However, the falling inflation rate and weakening economy mean that the pressure on the monetary authorities to reduce key interest rates is increasing. This is already reflected in the fixed-term deposit conditions, which are declining.

The average interest rates for current account accounts have almost quadrupled, while the interest rates for fixed-term deposits with a term of two years are above the inflation rate. Credit institutions active nationwide are increasingly competing for savers and therefore often offer higher interest rates. However, regional credit institutions, such as savings banks and cooperative banks, pay less interest on average.

The concern about the traditional savings bank DNA is that customers may not switch banks even though they could get significantly more interest elsewhere. The former savings bank president warned that low savings interest rates could scare away customers and that this would eat away at the savings banks' DNA of being an institution for saving.

Given these developments, it is important that savers carefully consider their investment decisions and pay attention to market developments in order to achieve the best risk-return ratio for their deposits.

Read the source article at www.n-tv.de

Suche

Suche

Mein Konto

Mein Konto